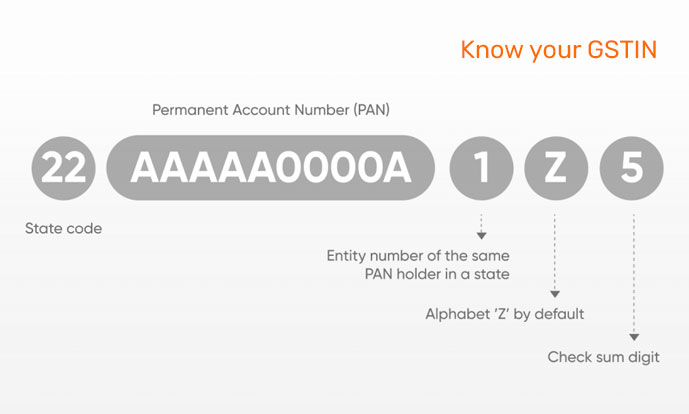

Before you do a GST number check, check out if the 15-digit GSTIN alphanumerical code is in the format below. If a GSTIN is not in this format, then it is not a valid GST number.

- GST, known as Goods and Services Tax, acts as an indirect tax imposed on the provision of goods and services within India. It is implementation saw the replacement of multiple indirect taxes such as excise duty, service tax, VAT, and more, thereby streamlining the taxation process.

GST is usually imposed on businesses, yet it is the end consumer who bears the tax burden. Registered businesses hold the responsibility of collecting and forwarding GST payments to the government.

In India, there are three main types of GST:

GST rates fluctuate depending on the nature of goods and services. They encompass several tax slabs, namely 5%, 12%, 18%, and 28%. Certain essential items may enjoy a 0% tax rate or fall within exempted categories.

Businesses surpassing a designated turnover threshold must register for GST. You can complete the registration process on the GST portal by providing the necessary documents and information.

ITC enables businesses to offset the GST paid on their purchases by claiming a credit. This credit can then be utilized to reduce the GST liability on their sales transactions.

For businesses falling below a specific turnover threshold, GST registration might not be obligatory. The threshold amount differs based on the business type and the state of operation.

Based on your turnover, GST returns should be filed regularly, with the frequency determined by your category, whether monthly, quarterly, or annually.

Failing to file GST returns on time may result in penalties and interest charges. Therefore, it is crucial to submit returns promptly to evade such repercussions.

Should you have overpaid GST, you can seek a refund by applying via the GST portal. This procedure may necessitate providing supporting documents for verification.

Exports usually incur zero-rated GST, whereas imports are subject to IGST. Specific provisions are in place to ensure the seamless flow of credit in such transactions.

The composition scheme is designed for small businesses operating within a restricted turnover. It enables them to remit GST at a fixed rate and submit simplified returns.

To correct errors in your GST returns, you can file a rectification return or amend the original return within specified timeframes.