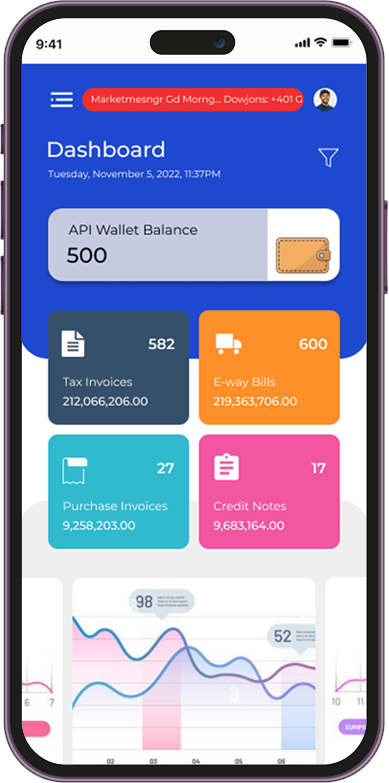

Empower your small business with our user-friendly GST billing software. Effortlessly create invoices, manage inventory, and stay compliant with GST regulations. Simplify your financial operations and focus on growing your business.

Notifications

GSTSof billing software provides a customisable GST Invoices & Bills with simple interface. We help to establish a professional brand identity while ensuring compliance with GST laws in India.

GSTSOF offers a comprehensive inventory management software solution loaded with a variety of features that can greatly benefit businesses in numerous ways.

GSTSOF accounting and billing software is a valuable asset for all enterprises to effectively their finances and maintain a strong cash flow.

GST filing can be complex and time-consuming for business owners, but GSTSOF billing software simplifies and speeds up the process.

GSTSOF - your knowledge and resource partner for everything related to GST.

Our GST solutions are designed to help save your time and effort.

A GSTSOF knowledge centre serves as a centralized platform providing comprehensive information and resources related to Goods and Services Tax (GST). Here's an overview of what you might find in such a centre.

GST return filing is the process where businesses report their sales, purchases, and tax liabilities to the tax authorities. It involves submitting various forms detailing transactions during a specific period. Timely and accurate GST return filing is crucial to ensure compliance with tax regulations and avoid penalties. Returns are typically filed monthly, quarterly, or annually, depending on the turnover and nature of the business.

Lifetime free basic usage implies that users can access a certain level of features or services without incurring any charges for the duration of their use. This offering may include essential functionalities at no cost, serving as an incentive for users to engage with the platform or service over an extended period.

Manage your invoice seamlessly denotes the ability to effortlessly handle and organize invoices without encountering difficulties. This feature ensures smooth and efficient invoice management, enhancing productivity and organization for businesses.

Track your users seamlessly refers to the effortless monitoring and analysis of user activity without disruptions. This capability enables businesses to gain valuable insights and optimize user experiences efficiently.

Manage your inventory space entails efficiently organizing and optimizing available storage areas without hassle. This functionality streamlines inventory management processes, ensuring effective space utilization and improved operational efficiency.

Manage your payment and receipt encompasses the seamless handling and tracking of both incoming and outgoing financial transactions. This feature facilitates efficient financial management, ensuring accuracy and clarity in payment processing for businesses.

File your GSTR return in a flawless manner a streamlined process for submitting GST returns without errors. This ensures compliance with tax regulations and minimizes the risk of penalties, providing peace of mind to businesses.

Supermarket chains are expansive networks of retail stores offering a wide range of products and services under one roof. These chains provide convenience and variety to customers while often implementing efficient supply chain management for seamless operations.

Medical shops and pharmacies" serve as essential outlets providing access to medications, healthcare products, and related services to communities. These establishments play a crucial role in promoting public health and well-being by offering a range of essential healthcare solutions.

Startups and SMEs refer to small and medium-sized enterprises that are innovative, agile, and often have a dynamic approach to business. They play a vital role in driving economic growth, fostering innovation, and creating employment opportunities within various industries.

We prioritize service and Satisfaction

We always try to give our best for all our customers. All the complaints we

get will be our evaluation to get better and better.

- GSTSOF Accounting Software is a robust tool crafted to assist individuals and businesses in handling their financial data, invoicing, expenses, and beyond. It simplifies accounting tasks and helps maintain accurate financial records

Starting is simple. Contact GSTSOF and visit their website, click 'Sign Up,' and follow the steps to create your account. Once you are registered, you can begin using the software.

Our GSTSOF Accounting Software is tailored to suit various businesses, including freelancers, small enterprises, and large corporations. It can be personalized to meet your specific requirements.

Yes, you can try our software for free for 14 days! Just sign up for a trial account to check out our features and see if it meets your needs.

We value your data security. Your financial information is encrypted and stored safely. We use industry-standard security measures to keep your information protected.

Yes, you can easily import data from other software if it is in the right format. Reach out to our support team for help.

We accept different types of payment methods like credit cards, debit cards, and online gateways. Pick the one that works for you.

Of course! Our customer support team is ready to help with any questions or concerns. Just email us at [email protected] or call us at +91 81128 11270.

Yes, we offer tutorials, user guides, and online training sessions to help you use our software effectively. Check out our support section for details.

You can cancel your subscription anytime. Just reach out to our support team, and they will help you through it.

Yes, we offer special pricing for businesses looking to buy in bulk or subscribe long-term. Contact our sales team for details.

Yes, you can upgrade or downgrade your subscription anytime to match your evolving business requirements.

No, Our pricing is transparent. There are no hidden fees or charges.

If you have any further questions or need assistance, feel free to reach out to our support team at [email protected] / +91 8112811270.

At GSTSOF, we are always here to hear from you.

For established carriers, easily connect with distribution partners, regardless of your current systems.

If you like what we are doing we do love to hear from you! Your appreciation motivates us to improve our services.

And if you think we can do better, please share your feedback and suggestions.

Call us, email us, or stop by for a cup of coffee. We are here to listen.

We are in over 20 cities across India.

We have a presence in over 20 cities throughout India, ensuring accessibility and convenience for our customers nationwide.

GST, or Goods and Services Tax, is an indirect tax levied on the supply of goods and services in India. It replaced various indirect taxes like excise duty, service tax, VAT, and others, simplifying the taxation system.

GST is typically levied on businesses, but the burden of the tax ultimately falls on the end consumer. Registered businesses are responsible for collecting and remitting GST to the government.

In India, there are three main types of GST:

GST rates vary for different goods and services. There are multiple tax slabs, including 5%, 12%, 18%, and 28%. Some essential items may be taxed at 0% or fall under exempted categories.

Businesses with a specified turnover are required to register for GST. You can register on the GST portal with the required documents and information.

ITC allows businesses to claim a credit for the GST they've paid on their purchases. It can be set off against the GST they owe on sales.

Businesses with a turnover below a certain threshold may be exempt from GST registration. This threshold varies by state and type of business.

GST returns must be filed regularly based on your category, such as monthly, quarterly, or annually. The frequency depends on your turnover.

Late filing of GST returns can lead to penalties and interest charges. It's essential to file returns promptly to avoid such consequences.

If you've paid excess GST, you can claim a refund by applying through the GST portal. The process may require supporting documentation.

Exports are typically zero-rated, while imports are subject to IGST. Special provisions apply to ensure the proper flow of credit.

The composition scheme is available for small businesses with a limited turnover. It allows them to pay GST at a fixed rate and file simplified returns.

You can rectify errors in your GST returns by filing a rectification return or amending the original return within specified time limits.

Income tax is a direct tax levied by the government on individuals and businesses based on their earnings. It's a major source of revenue for the government to fund public services.

Income tax is calculated based on the income earned by an individual or business within a specified tax year. Tax rates and deductions vary by income level and type of income.

The deadline for filing income tax returns varies by country but is typically around April 15th in many places. Exact dates can change, so it's crucial to check with the local tax authorities.

In most countries, individuals and businesses with income above a certain threshold are required to file income tax returns. Some sources of income may also require reporting, even if they don't meet the threshold.

Common taxable income sources include salary, business income, rental income, interest, dividends, capital gains, and more. The specifics can vary by country and tax regulations.

Yes, you can often reduce your taxable income through deductions and credits. Common deductions include mortgage interest, charitable contributions, and educational expenses.

You can report and pay income tax through tax returns, either online or on paper, depending on your country's tax authority. Online filing is becoming increasingly common and efficient.

Late filing or payment can lead to penalties and interest charges. It's crucial to file your taxes on time or request an extension if you can't meet the deadline.

A tax refund is the amount you receive from the government when you've overpaid your taxes. A tax liability is the amount you owe to the government after considering your income and deductions.

Most countries offer e-filing options, allowing you to submit your income tax return electronically. It's a quicker and more convenient way to file your taxes.

Yes, you can typically amend your tax return if you've made an error or need to make changes. This is done by filing an amended return with the necessary corrections.

Yes, it's essential to maintain records of financial transactions, including income, expenses, and deductions, in case you're audited or need to substantiate your claims.

For established carriers, quickly enable seamless connections with distribution partners, no matter the systems you use today.If you think we are doing something good, then do send us a line of appreciation. It keeps us motivated and pushes us to raise our levels of service.

On the other hand, if you think we can improve, then please send in your feedback and suggestions.

Call us – mail us or drop in for a cup of coffee. We are listening.

We have a presence in over 20 cities throughout India, ensuring accessibility

and convenience for our customers nationwide.